All Categories

Featured

Table of Contents

It allows you to budget and plan for the future. You can easily factor your life insurance policy into your budget plan since the costs never transform. You can prepare for the future just as easily because you recognize specifically just how much cash your enjoyed ones will certainly receive in case of your absence.

This holds true for people who stopped smoking or that have a health and wellness problem that settles. In these situations, you'll generally need to go with a brand-new application process to get a better rate. If you still need protection by the time your level term life policy nears the expiration day, you have a few alternatives.

Most degree term life insurance policy policies come with the choice to restore insurance coverage on a yearly basis after the first term ends. level term life insurance meaning. The cost of your plan will be based upon your present age and it'll enhance annually. This could be a great alternative if you only require to expand your coverage for one or two years otherwise, it can get costly pretty quickly

Degree term life insurance policy is one of the most affordable coverage alternatives on the market because it provides fundamental protection in the form of fatality benefit and just lasts for a set time period. At the end of the term, it expires. Whole life insurance policy, on the various other hand, is dramatically more pricey than level term life due to the fact that it doesn't run out and includes a cash money worth attribute.

Term Life Insurance With Accelerated Death Benefit

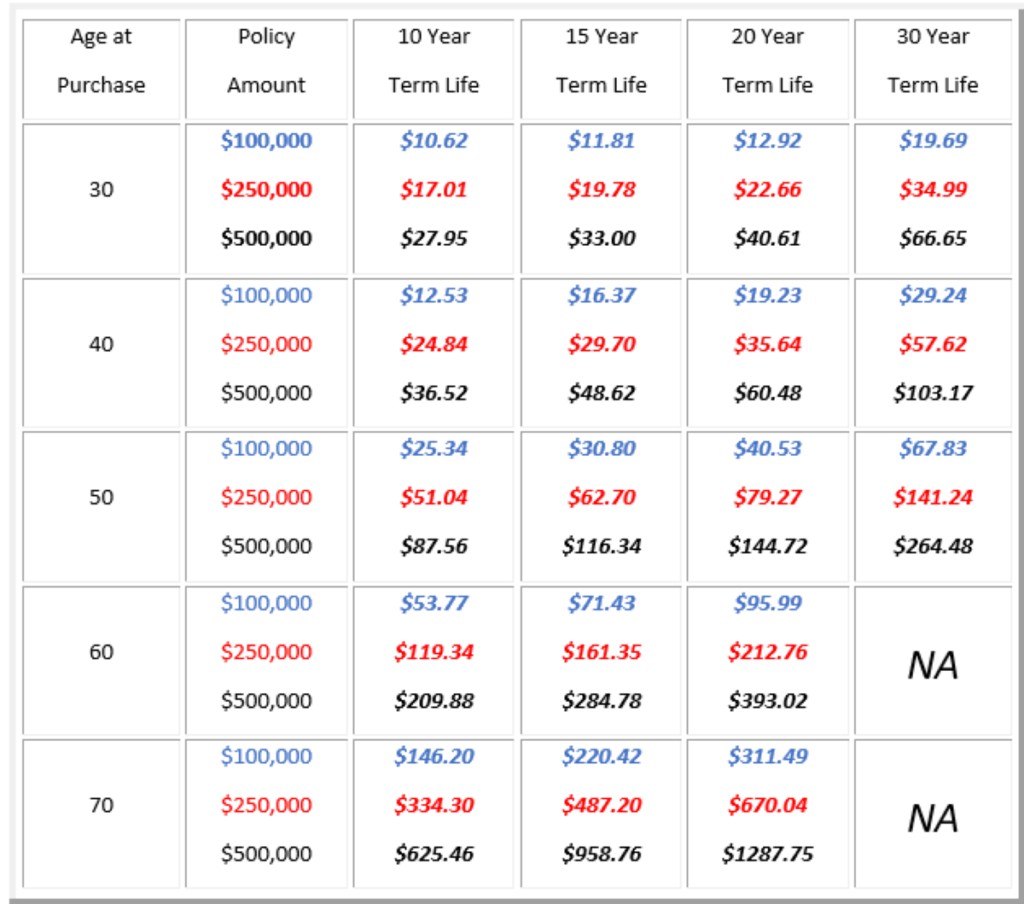

Rates might differ by insurance provider, term, protection quantity, health and wellness class, and state. Not all policies are offered in all states. Price illustration valid as of 10/01/2024. Degree term is a great life insurance option for most individuals, yet depending upon your insurance coverage requirements and personal circumstance, it could not be the most effective suitable for you.

Yearly renewable term life insurance policy has a term of only one year and can be renewed yearly. Annual renewable term life premiums are originally less than degree term life costs, however rates increase each time you restore. This can be an excellent alternative if you, for instance, have just stop smoking and require to wait two or 3 years to obtain a degree term policy and be qualified for a reduced rate.

Proven Level Term Life Insurance Definition

With a lowering term life plan, your death advantage payment will certainly decrease in time, but your repayments will remain the exact same. Decreasing term life plans like mortgage protection insurance generally pay out to your lending institution, so if you're searching for a policy that will certainly pay to your enjoyed ones, this is not an excellent fit for you.

Raising term life insurance policy policies can aid you hedge against inflation or strategy financially for future youngsters. On the other hand, you'll pay more in advance for much less coverage with a raising term life policy than with a degree term life policy. If you're not sure which type of policy is best for you, dealing with an independent broker can aid.

As soon as you have actually determined that level term is appropriate for you, the next step is to acquire your plan. Below's how to do it. Calculate how much life insurance policy you need Your coverage amount should offer your household's lasting economic demands, consisting of the loss of your income in case of your death, along with debts and everyday costs.

A level premium term life insurance policy strategy allows you stick to your spending plan while you assist safeguard your household. ___ Aon Insurance Coverage Services is the brand name for the brokerage and program management procedures of Affinity Insurance policy Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Coverage Agency, Inc. (CA 0795465); in Okay, AIS Fondness Insurance Coverage Solutions Inc.; in CA, Aon Affinity Insurance Providers, Inc.

The Plan Agent of the AICPA Insurance Policy Trust Fund, Aon Insurance Solutions, is not associated with Prudential.

Latest Posts

10000 Dollar Life Insurance Policy

Funeral Costs Calculator

Types Of Final Expense Insurance